Irs 2024 Schedule B Instructions – The Internal Revenue Service recently released a guide for filing an accurate return with everything to know before filing, and what has changed in tax law in 2024. Here is everything to know before . Taxpayers could have started filing their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you .

Irs 2024 Schedule B Instructions

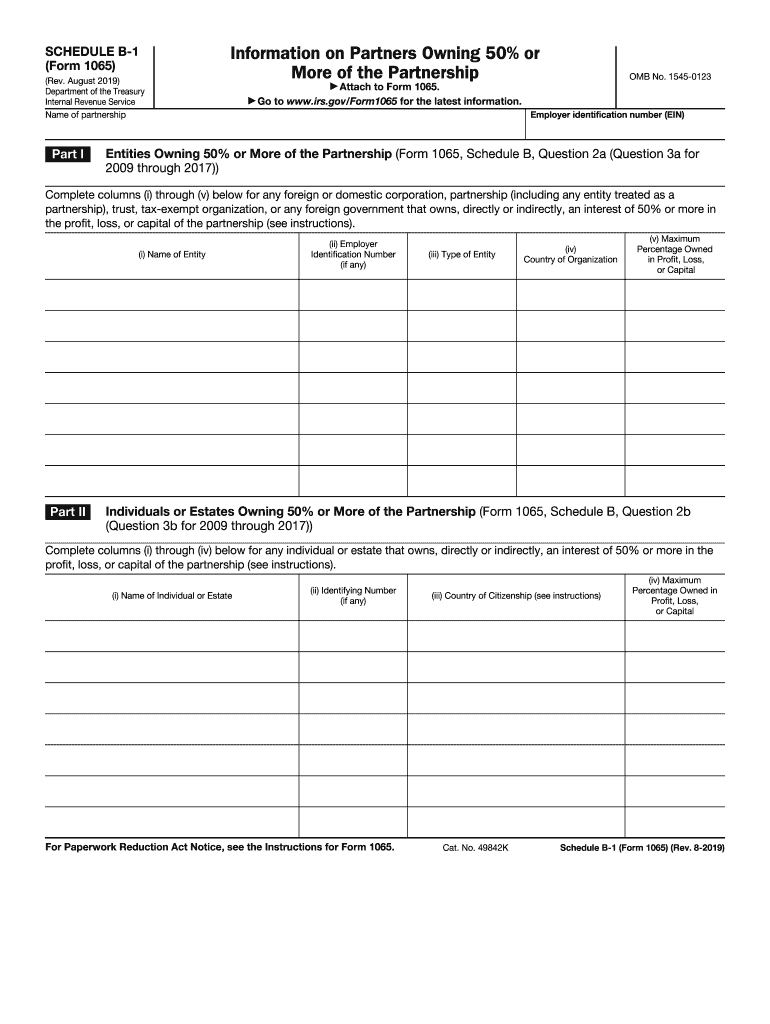

Source : www.irs.gov2019 2024 Form IRS 1065 Schedule B 1 Fill Online, Printable

Source : form-1065-schedule-b-1.pdffiller.comInstructions for Schedule M 3 (Form 1120 PC) (Rev. January 2024)

Source : www.irs.govIrs instructions schedule b: Fill out & sign online | DocHub

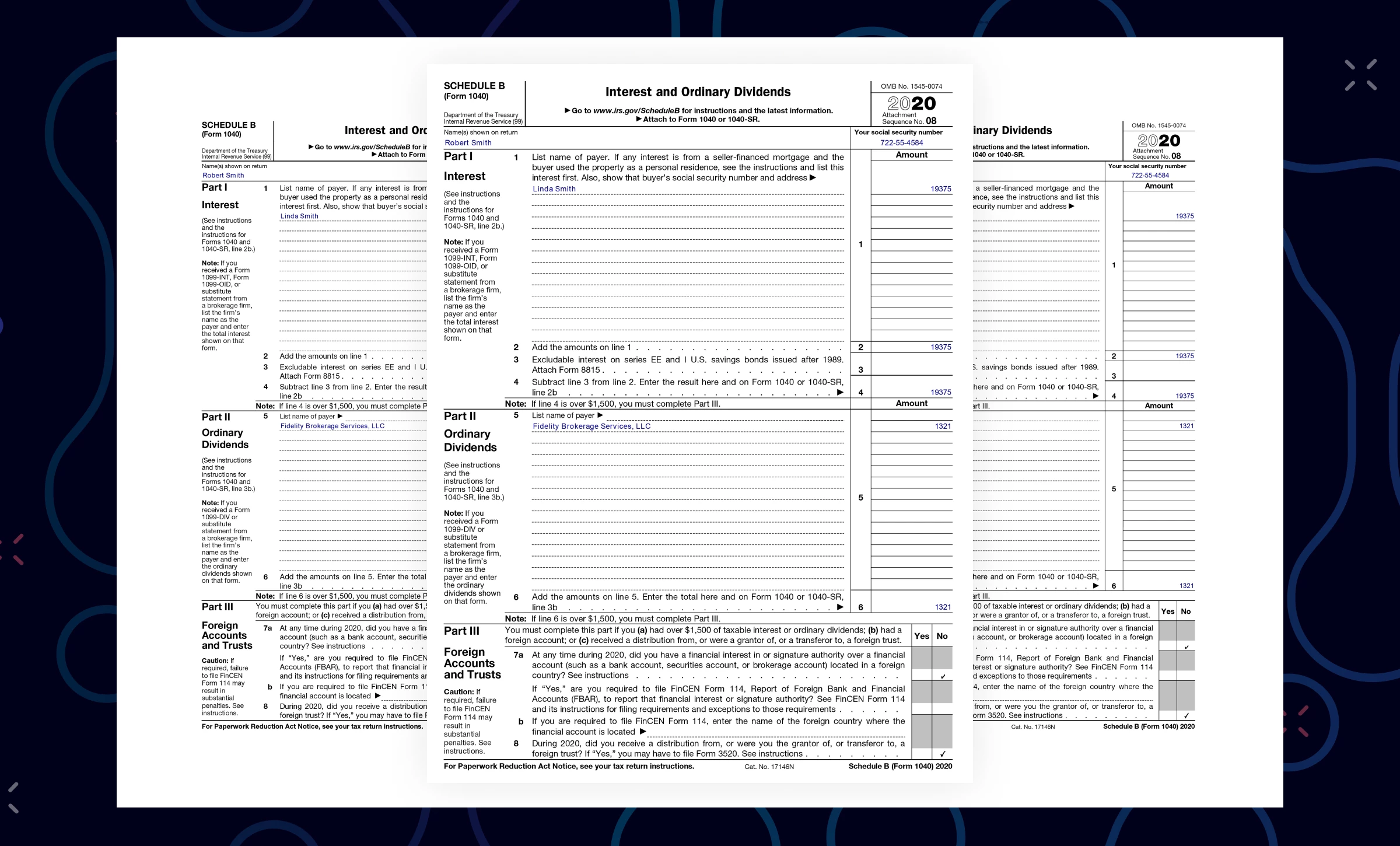

Source : www.dochub.comIRS Form 1040 Schedule B 2020 Document Processing

Source : www.ocrolus.comNew IRS Schedule B Tax Form Instructions and Printable Forms for

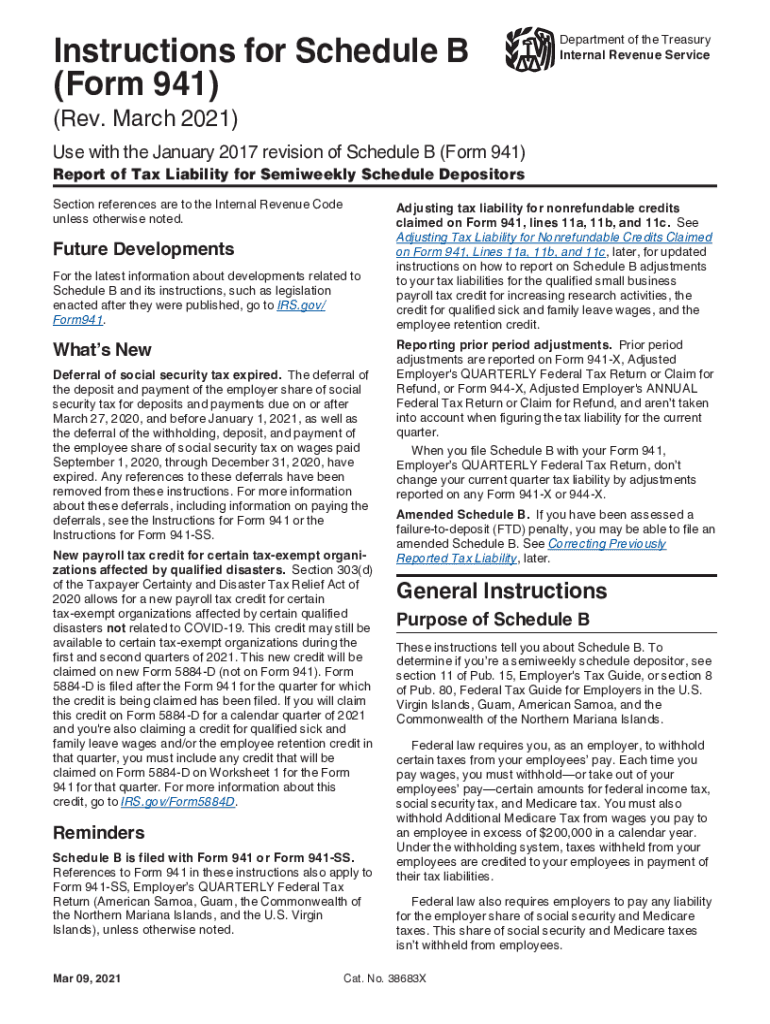

Source : www.wivb.com2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comIrs Schedule B for 2018 2024 Form Fill Out and Sign Printable

Source : www.signnow.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgIrs 2024 Schedule B Instructions 2023 Instructions for Schedule B: Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The . Californians pay the highest marginal state income tax rate in the country — 13.3%, according to Tax Foundation data. But California has a graduated tax rate, which means your rate increases .

]]>